Using clicks to create a fairer tax world |

|

In August, 2018, Jeremy Corbyn announced his intention to introduce a Digital Licence Fee. The idea behind this tax would be to get the internet giants (Facebook, Apple, Amazon , Netflix & Google) to subsidise the BBC and remove the need for the corporation to keep coming back to the government to set a new licence fee. |

| This is a wholly good idea but it does not solve the issue of the threat to bricks and mortar retailers from online traders. |  |

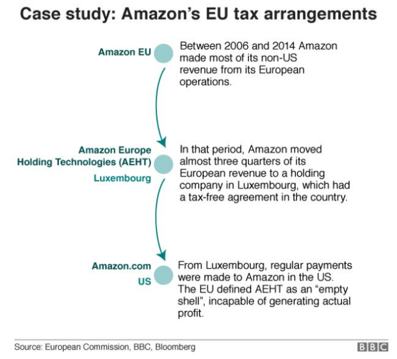

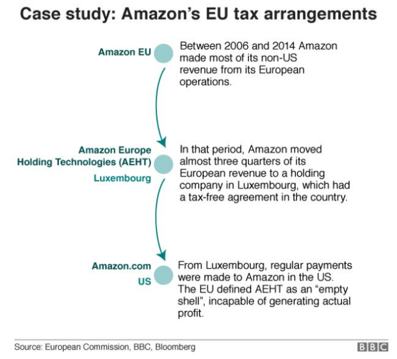

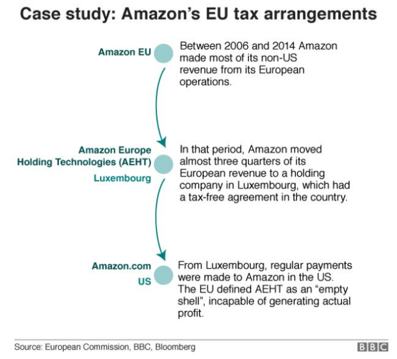

| Apart from anything, online traders are good at concealing or distorting their turnover and profit, see case study (right). |

| One of the most important aspects of business rates is that it is a tax that has to be paid. It is extremely hard for any large bricks and mortar retailer to avoid or evade it. |

| To level the playing field we need an equivalent way to tax the online traders. Click tax would be that equivalent. |

| The idea is to get ISPs to bill internet giants for connections to their web sites. Online traders like Facebook can not disguise the number of clicks they get since it is a key aspect of their business model. They need the clicks to charge their customers. Right now there are uniquely favourable circumstances for the introduction of click tax. Thanks to the Investigatory Powers Act all the required data is being collected. In addition to making the tax simple to introduce it also makes it easy to set it at an appropriate level (or appropriate levels, since some web sites, such as those run by gambling companies, might have a higher tax rate than others).

|

|

Discover the total number of clicks on the web sites of internet giants (there would be little point in taxing the small fry) and then set the tax at the approriate number of clicks per penny in order to raise the sum required.

|

|

Up until recently the main constraint holding back the introduction of click tax was the concept of Net Neutrality: the idea that no internet user should be prevented or slowed from going to any site. But America has recently abandoned its stance on net neutrality. |

| In 2017/18 the total non domestic rate collection in England was £23.8 billion and a further £945 million was collected in Wales. Non domestic rates has to be paid by both industry and retail sectors. In total, then, we need to have a click tax that produces about a quarter of non-domestic rates (surveyors Altus Group estimates that the retail element of non-domestic rates is a shade more than 25%). That works out at about £6.3 billion. |

| The ratio of clicks to bricks and mortar spending reached a record 18.4% in August 2018 (source: ONS). So the target should be to produce a click tax that is about 20% of £6.3 billion (or £1.26 billion). |

| In December, France announced that it planned to introduce a levy on tech giants. French finance minister Bruno Le Maire predicted this new tax would raise €500m euros in 2019, a relatively small sum in the great scheme of things. But the French have significant problems so they may find it politic to just dip a toe in the water. For a start opposition is expected from the Americans, who may not like the Europeans taxing their corporations. |

| Secondly to introduce a tax EU rules require member state unanimity and Ireland (where several of the tech giants have their European HQs) is expected to oppose the tax. It is possible that the Conservative's EU withdrawal deal may include a requirement that effectively prevents Britain from introducing a tax on internet companies. However Bruno Le Maire told journalists in December that France would introduce the tax come what may. Presumably the UK could do the same. |

| In 2018 the European Commission proposed a 3% tax on the revenues of large inernet business. The Commission has said it wants to tax companies where they are based. The French government's decision to go ahead unilaterally makes it clear that not everyone is pleased with the progress the commission is making. |

| The UK, Spain and Italy are all working on different versions of a digital tax. Philip Hammond announced in the 2018 Budget that there would be consultations designed to create a digital services tax to be introduced in April 2020.The Organisation for Economic Cooperation and Development is also drafting a proposal for a new international scheme that would regulate taxation on tech firms. | Click to see next page. |

| But even if a turnover or profit tax is introduced, a government might still have a click tax. Right now retailers pay VAT and Corporation Tax as well as Business Rates.

| |

| Click below to see an item or return to index. | |

| <1> Using clicks to create a fairer tax world | |

| <2> Net Neutrality | |

| <3> Collecting the data | |

| <4> Saving the high street? | |

| <5> Gambling | |

| <6> The size of it | |

| Return to index | |