Saving the high street? |

|

Click tax is unlikely, on its own, to transform the prospects of bricks and mortar retailers. The changes going on are far too deep seated and of an entirely different scale.

However, it could make a contribution and give retailers more confidence in the future. It could also be used to stem widespread tax evasion or avoidance.

|

| At present some online sales platforms do not charge VAT and consumers can get a nasty surprise when products they think they have paid for, get held up in the post and they get a bill from the tax office. But most items, particularly low priced goods, get through without paying tax at all.

|

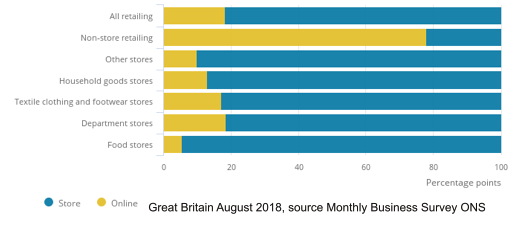

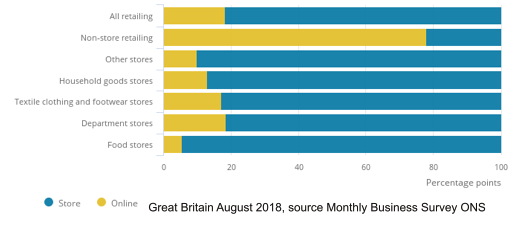

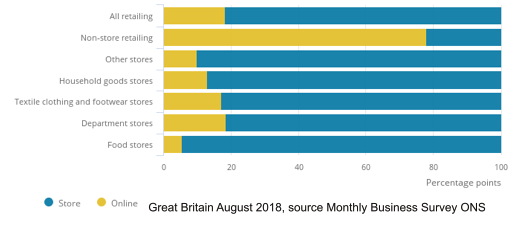

Proportion of sales in stores and online  |

| Organisations that refuse to levy British taxes could face a higher rate of Click tax.

|

| Super click tax could also be levied on gambling organisations.

| Click to see next page. |

| Click below to see an item or return to index. | |

| <1> Using clicks to create a fairer tax world | |

| <2> Net Neutrality | |

| <3> Collecting the data | |

| <4> Saving the high street? | |

| <5> Gambling | |

| <6> The size of it | |

| Return to index | |