The size of it |

|

There are four major ISPs plus some smaller specialist operators (satellite, for example) and between them they have something like 20 million customers. The four are: BT (Plus net, EE), Sky Broadband, Virgin Media and TalkTalk. To raise £1.26 billion ISPs would need to charge about £63 for each customer.

|

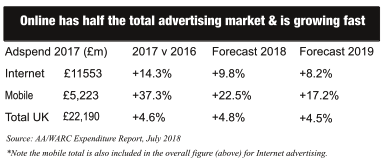

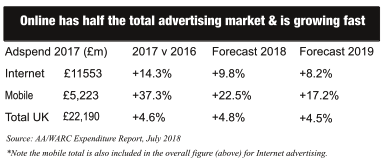

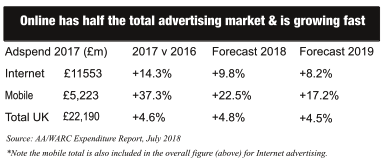

| According to the Advertising Association something like £16.7 billion was spent on online advertising in 2017 (the latest figures available at January 2019), an extraordinary £835 per ISP account. |

|

That would mean an effective tax rate of 7.5%. Hardly onerous. Of course, advertising is only one factor. Gambling and direct sales (Ebay, Amazon) would also generate Click Tax so the effective tax rate could be much lower than 7.5% yet still raise £1.26 billion. The level set for click tax at £63 per customer might seem quite high, but in the great scheme of things this is a very modest amount; and, of course, customers do not actually have to pay. |

| According to a Which Report, released in January 2019, customers who fail to haggle with their ISPs, can be paying £500 more than new users of exactly the same broadband and tv package.

Which found that the average loyal Virgin Media customer was paying £960 a year, £576 more than the cost of Virgin's basic bundle (see Independent Business News January 11, 2019).

|  |

| To reiterate, no customer should ever have to pay their ISP more as a result of click tax; but these figures give an overall perspective and show how small a contribution an average of £63 per customer is. This is true both in terms of the amount of money the ISPs are charging for broadband connections and the revenues generated by internet giants.

|

| Click to see next or return to index. | |

| <1> Using clicks to create a fairer tax world | |

| <2> Net Neutrality | |

| <3> Collecting the data | |

| <4> Saving the high street? | |

| <5> Gambling | |

| <6> The size of it | |

| Return to index | |