| Conference recognises that the internet giants have become over mighty corporations who do not make a fair contribution to tax or employment and who threaten the existence of the high street through unfair competition. Conference calls on Labour to campaign for the introduction of a tax to level the playing field between bricks and mortar and click retailers and take back control.

Such a tax would be levied on the Internet Service Providers with a clear understanding that they would collect it from the giant corporations and shut them down in the UK, if they failed to pay. Click tax would be the online equivalent of business rates, helping to defend that highly efficient tax from the massive attack by business interests, who hate it because it is almost impossible to evade or avoid.

Click tax would be levied on the basis of the agglomeration of the audit of internet usage currently kept by ISPs as a result of the the Investigatory Powers Act of 2016, which forces ISPs to keep a record of the clicks of all users for the previous 12 months.

It would be levied at rates calculated for different sectors: gambling companies, sales platforms that refuse to collect VAT and retailers being obvious categories. Only internet giants would have to pay click tax since there would be a high threshold before it became chargeable.

|

Click to see larger version. Click to see larger version.

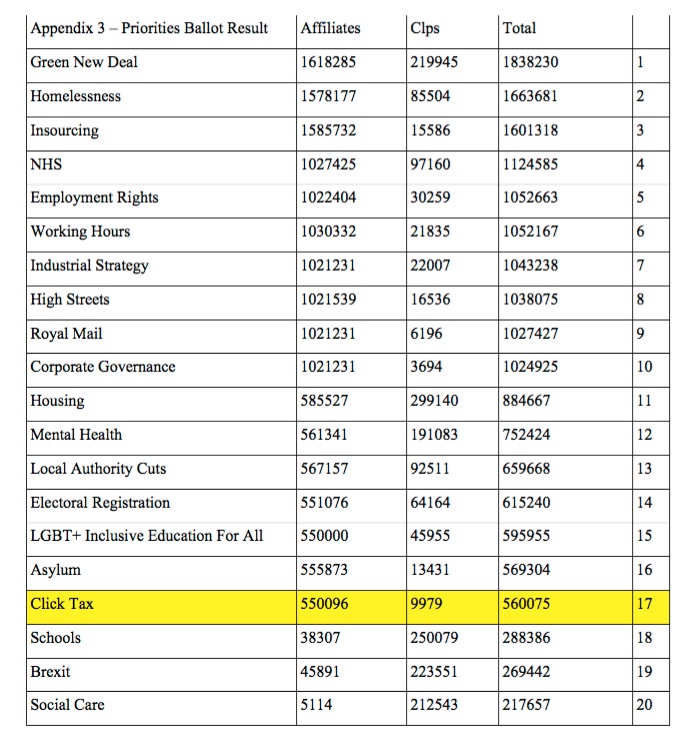

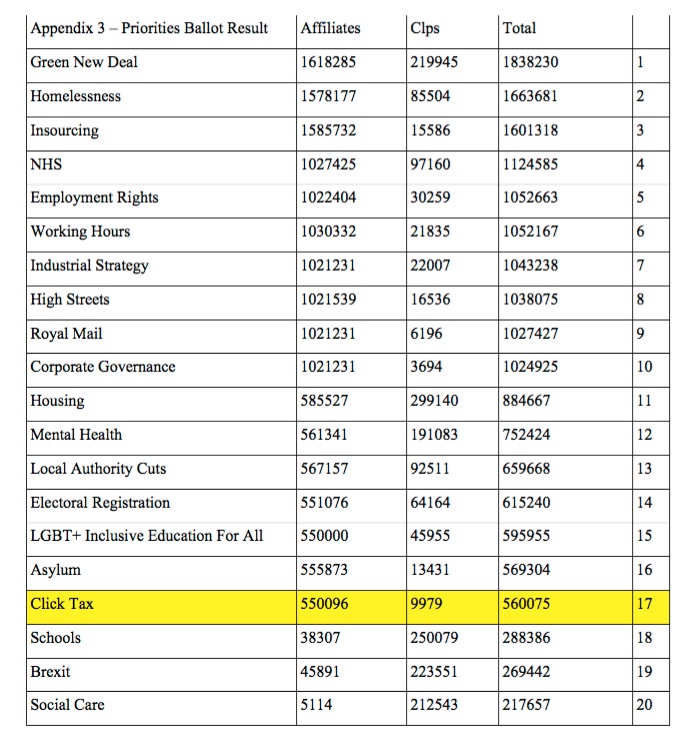

Clicktax came 17th in the Labour Party Priorities ballot (the selection of resolutions for conferece to discuss) in 2019. Since 20 resolutions were to be debated, it would seem as if Clicktax should have been on the agenda. But the system doesn't work like that. The top 10 resolutions supported by unions get debated as do the top 10 supported by constituency parties. Although click tax got a lot of trade union and socialist society votes, the resolution did not come in the top ten in either section. |

Click to see larger version.

Click to see larger version.